Top Things

- Treasuries Correct as Ten Year Rises

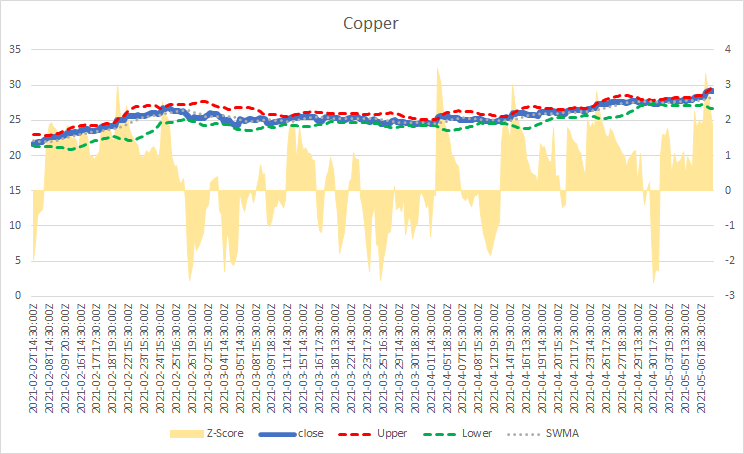

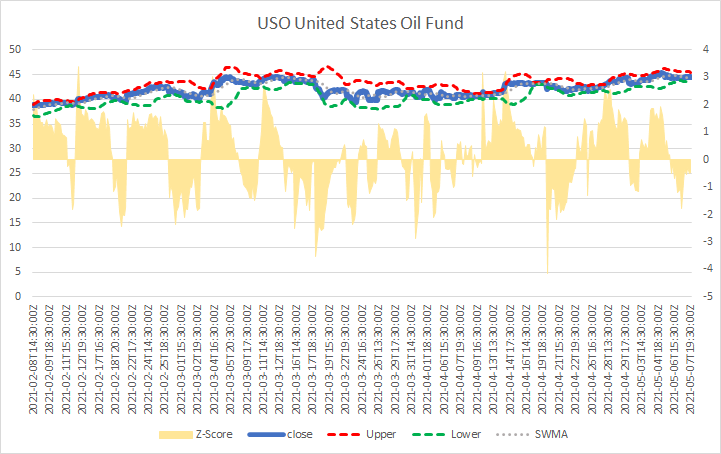

- Commodities continue to ramp higher

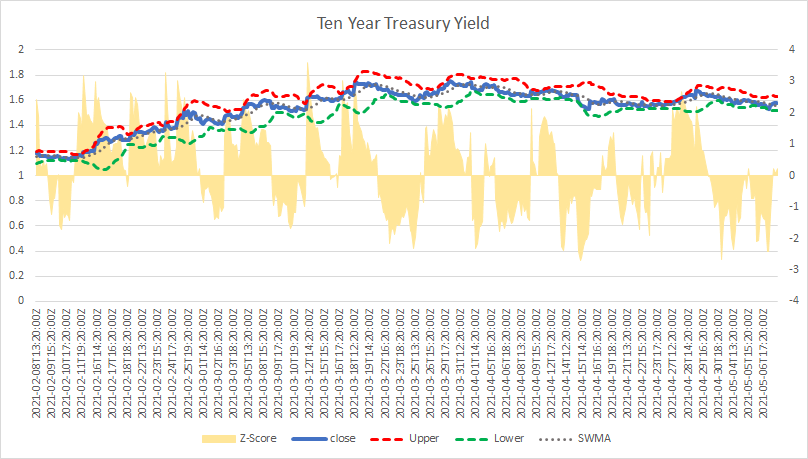

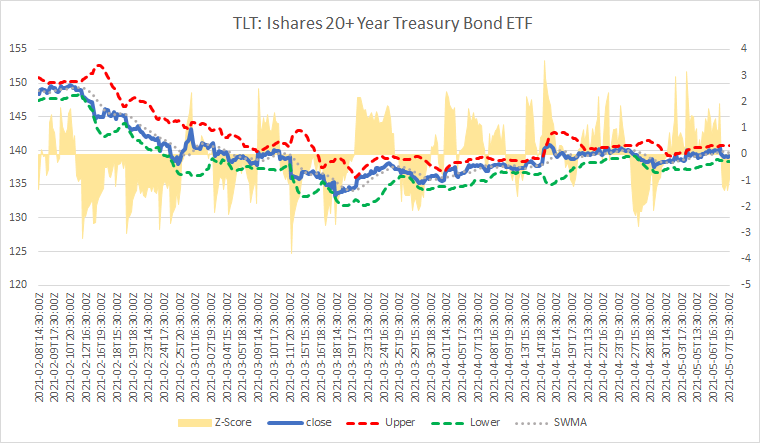

The 10 year treasury reversed course as the market switched to risk on again. The ten year rate of change is negative on the day, and week while also staying firmly bullish trend up 32.78% in the last 90 days. This highlights the markets view of higher prices and inflation still to come. This is also showing up in bond prices which are still bearish trend as TLT is down -6.28% in the last 90days.

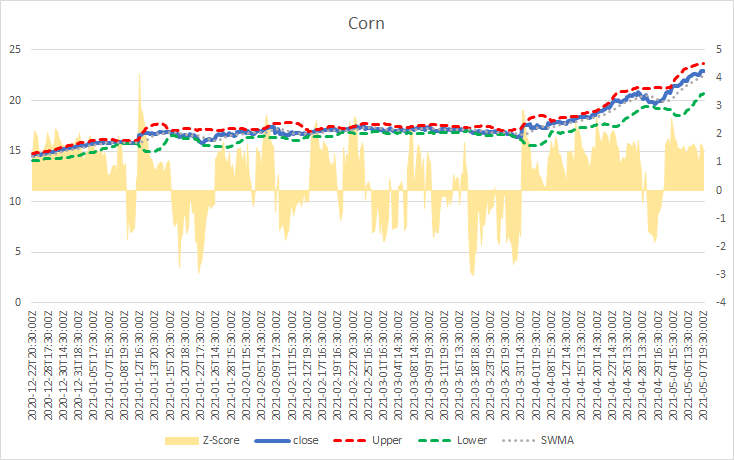

Contrast this with commodities and you truly see the market's inflationary story. We all know the lumber story, but inflation is also showing up in CORN, CPER, and USO.

This continues to show that both growth and inflation accelerating are still manifesting in market positioning. With the VIX rate of change bearish (day, week, month, and quarter), while yields and commodities bullish the market is still pricing in more inflation. We spoke about an economic transition last week to potentially growth increasing while inflation is decreasing in the back half of the year. This last week has showed us that the market isn't transitioning just yet. Continuing holding investments that do well when both growth and inflation are rising.

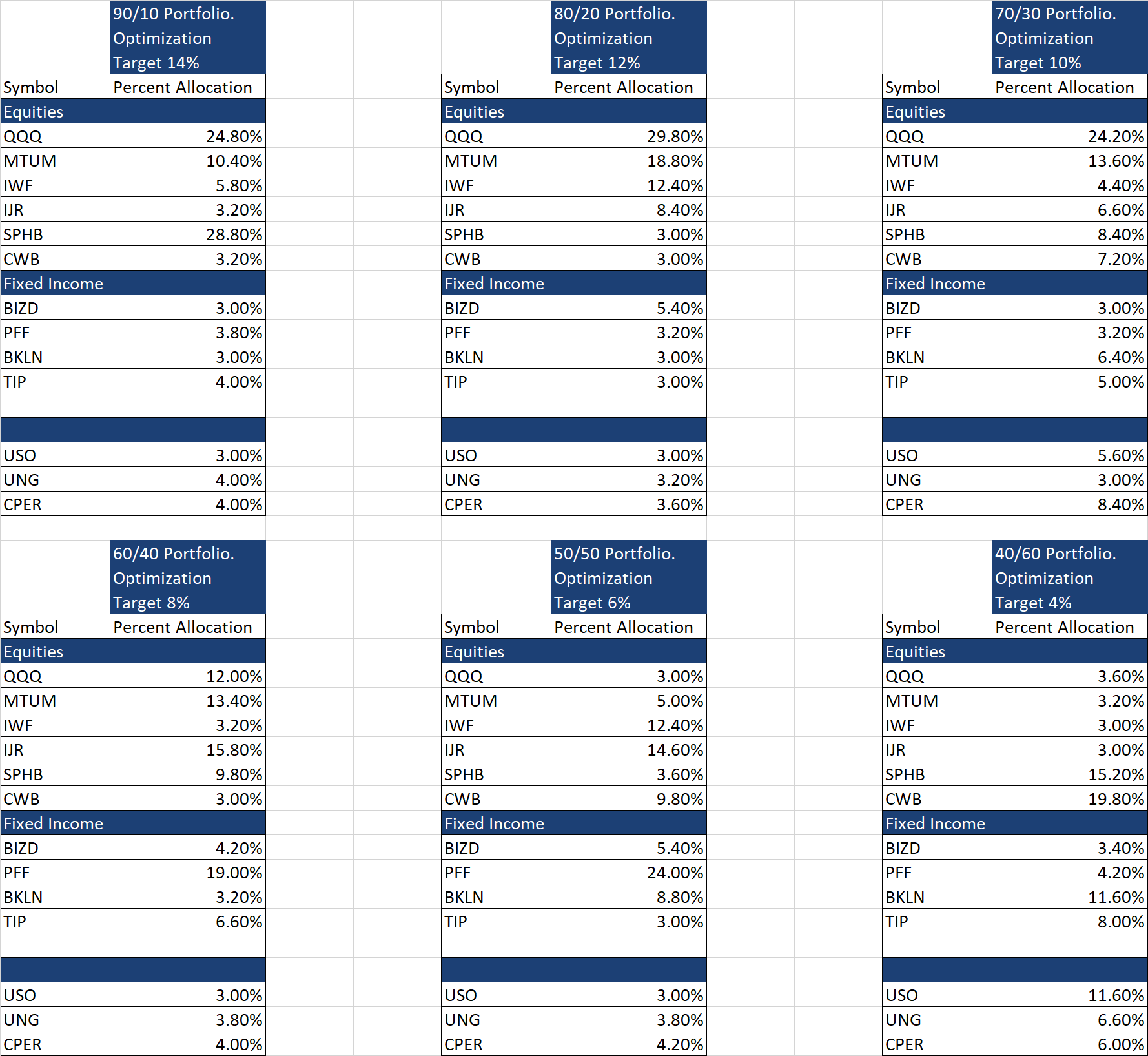

Daily Portfolio Optimization